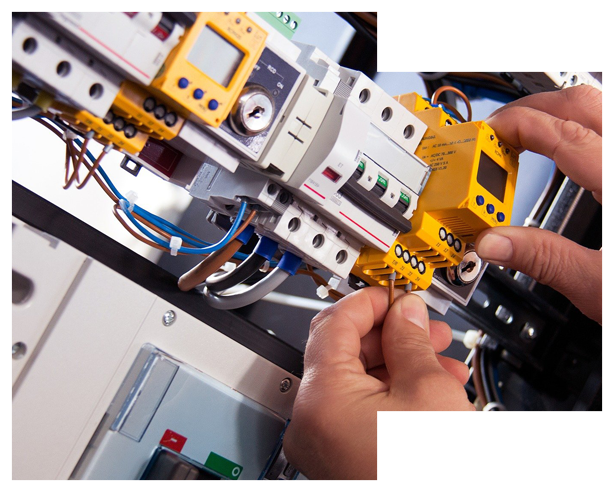

What types of insurance do electricians need?

These policies provide coverage for the most common electrician risks.

General liability insurance

This policy covers common electrician risks, such as a client tripping on a loose cable and breaking a leg. Bundle with property insurance for savings in a business owner's policy.

BEST FOR

-

Slip-and-fall accidents

-

Damaged customer property

-

Libel or slander lawsuits

Workers’ compensation insurance

Workers’ compensation insurance is required in almost every state for electrician businesses that have employees. It can cover medical bills for work-related injuries.

BEST FOR

-

Employee medical expenses

-

Missed wages

-

Employee injury lawsuits

Commercial auto insurance

Electrician insurance that covers third-party injuries and property damage caused by company vehicles, as well as repairs to vehicles damaged by weather or vandalism.

BEST FOR

-

Physical damage and collision coverage

-

Injuries caused to another person

-

Vandalism and theft

Contractor’s tools and equipment insurance

This policy helps pay for repair or replacement of an electrical contractor’s voltage testers, wire strippers, and other tools if they are lost, stolen, or damaged.

BEST FOR

-

Equipment less than five years old

-

Mobile equipment

-

Small tools

How much does insurance cost for electricians?

Several factors will have an impact on insurance costs, including:

Electrical services offered, such as residential or commercial wiring

Business equipment and property

Revenue

Number of employees

Why do electricians need insurance?

Working with live wires incurs a high level of risk. Beyond the risk of bodily injury, a customer could file a lawsuit over property damage, or a company car could get in an accident. Electrical insurance can cover lawsuits and other expenses that your small business might otherwise struggle to pay.